tax avoidance vs tax evasion examples

There is certainly a distinction between tax avoidance and tax evasion. Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash savings investing money into a pension scheme or claiming capital allowances on things used for business purposes.

Tax Planning Tax Evasion Tax Avoidance And Tax Management Avs Associates

Mailing tax forms on time C.

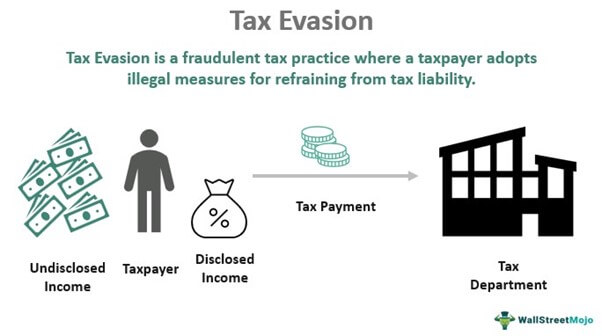

. Keeping a tip log B. Tax evasion means concealing income or information from tax authorities and its illegal. What is tax evasion.

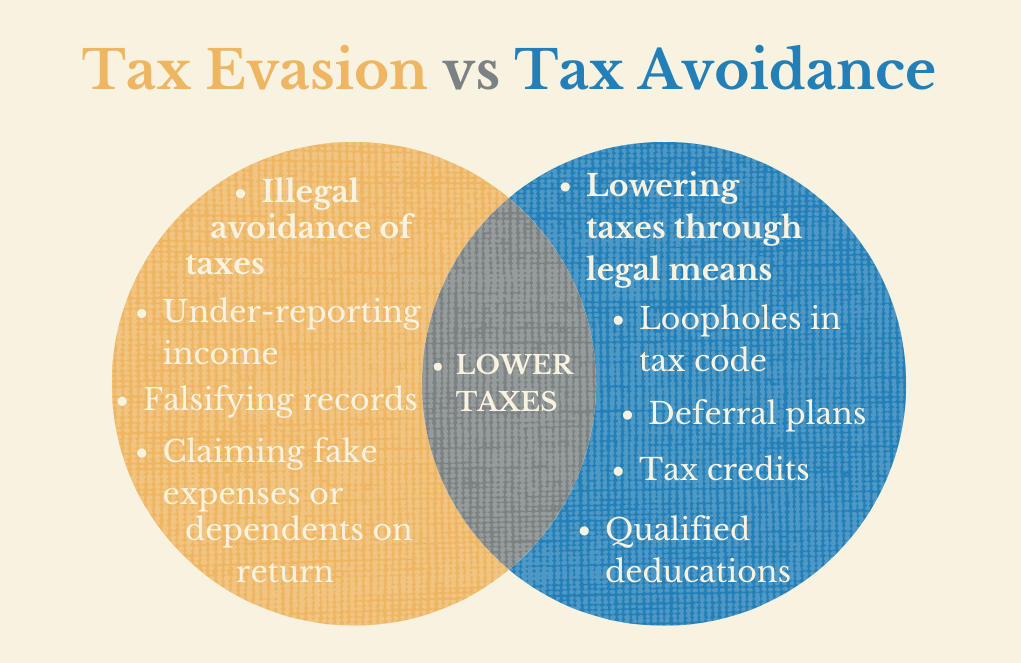

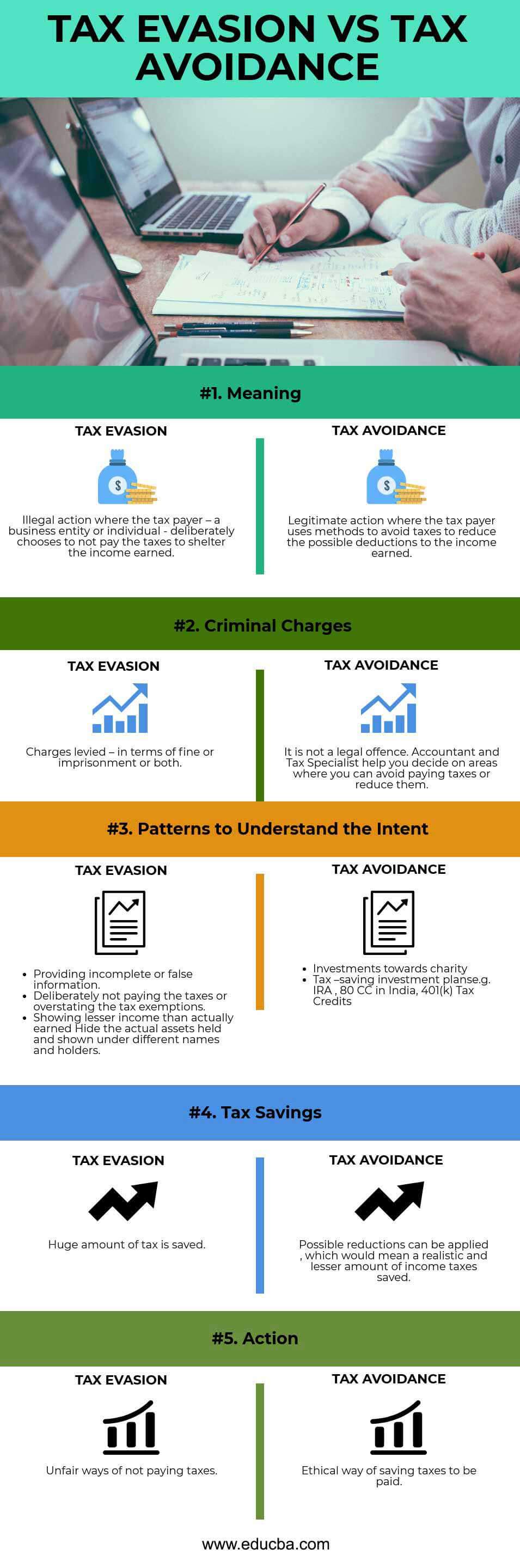

Often taxpayers can overlook their cryptocurrency holdings that have increased in value. The use of the term noncompliance is used differently by different authors. Tax avoidance can be termed as an ethical way of reducing taxes and tax evasion can be called an unethical way of reducing the tax burden.

Deductions are a great way to reduce your taxable income. Some may only pay a part of their taxes and leave out the rest. Tax evasion is totally different from tax avoidance.

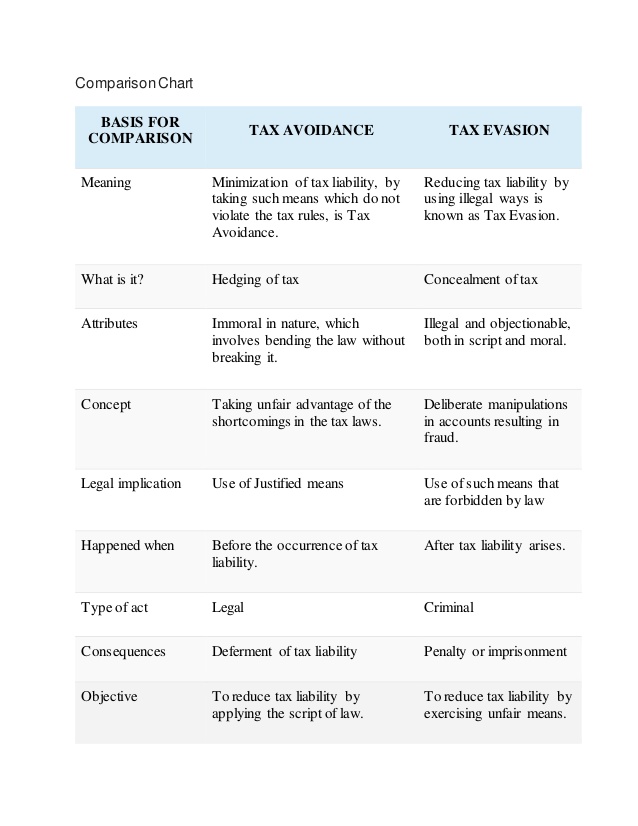

An example of tax avoidance is a situation where a person owns a business and employs his or her spouse. This could include travel. While they may sound similar tax avoidance is the legal practice of minimizing tax liability within the framework of the tax code in contrast to tax evasion which is the deliberate failure to pay taxes or comply with tax law.

Examples of tax avoidance. 1 Ignoring overseas income. Tax avoidance includes taking advantage of tax deductions and using tax shelters to.

Ignoring earnings for pet-sitting. Falsification of accounts manipulation of accounts overstating expenses or understating income conducting black market transactions are all examples of tax evasion. There are a number of prominent examples of tax avoidance.

Not reporting interest earned on loans C. Tax evasion is illegal and can potentially get you criminally charged and sentenced to prison fined or both. The IRS has rules about cryptocurrencies and their transactions are taxable.

Tax Evasion vs. Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object and spirit of the law. Both of these grow tax-free which means there is no tax to pay on interest earned.

In tax avoidance you structure your affairs to pay the least possible amount of tax due. Activity 1 Circle each example of tax evasion. Ignoring earnings for pet-sitting D.

Distributions and withdrawals will usually be taxed at your then-income tax rate in retirement. The other one is the evasion of payment. When you see a commercial for a charity on television that mentions a tax-deductible donation that is an example of an opportunity for tax avoidance.

Tax Evasion vs. Take advantage of each deduction. In tax evasion you hide or lie about your income and assets altogether.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Tax Avoidance Examples of tax avoidance strategies Tax deductions and credits. For example if someone transfers assets to prevent the IRS from determining their actual tax liability there is an attempted to evade assessment.

Some common examples of tax avoidance include. For instance businesses participate in tax avoidance by taking deductions and by protecting their income with employee retirement plans and more. Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the correct answer.

Giving to charity as discussed above is one of the most common. Tax evasion is often confused with tax avoidance. Contributing to tax-advantaged IRAs and 401 k plans.

Tax Evasion VS Tax Avoidance. Tax avoidance means legally reducing your. Its most general use describes non.

Tax Avoidance Examples. Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. The IRS will deduct expenses for non-reimbursed business expenses.

This includes not paying taxes you owe even though your income is reported. While you use legal methods to minimize your taxable income in tax avoidance tax evasion is when a taxpayer utilizes various unlawful methods to get rid of paying taxes. While you get reduced taxes with tax avoidance tax evasion can result in fines penalties imprisonment or.

Tax avoidance is perfectly legal and encouraged by the IRS but tax evasion is against the law. 2 Banking on Bitcoin. Tax evasion is the use of illegal means to avoid paying your taxes.

Keeping accurate and organized records E. The main difference between a form of tax evasion vs avoidance is whether the action taken to reduce ones tax burden is illegal. When you make a donation to charity you get to.

1 Keeping a log of business expenses. This is one of the most common tax evasion examples. If income is not reported by someone authorities do not possess a tax claim on them.

The difference between tax avoidance and tax evasion boils down to the element of concealing. To assess your answers click the Check My Answers button at the bottom of the page. Federal income tax than necessary because they misunderstand tax laws and fail to keep good records.

Tax avoidance schemes make use of loopholes or deliberate lawmaker decisions to reduce ones tax burden. Tax noncompliance informally tax avoision is a range of activities that are unfavorable to a governments tax system. Examples of tax evasion.

This often affects people with rental properties overseas. Here are some examples of tax evasion. This may include tax avoidance which is tax reduction by legal means and tax evasion which is the criminal non-payment of tax liabilities.

Tax evasion occurs when the taxpayer either evades assessment or evades payment. Any form of tax evasion tends to be explicitly illegal according to the tax code. Tax avoidance is the legal minimizing of taxes in which one employs methods in line with the tax code.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion The Big Difference Taxes Taxplan How To Plan Tax Services Tax

Definitions Of Tax Avoidance Forms And Tax Evasion Download Scientific Diagram

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Evasion Tax Avoidance Definition Comparison For Kids

The Tax Lady Dear Taxpayers Long Story Short Tax Avoidance Vs Tax Evasion Tax Evasion Is Illegal Facebook

Tax Evasion Meaning Types Examples Penalties

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

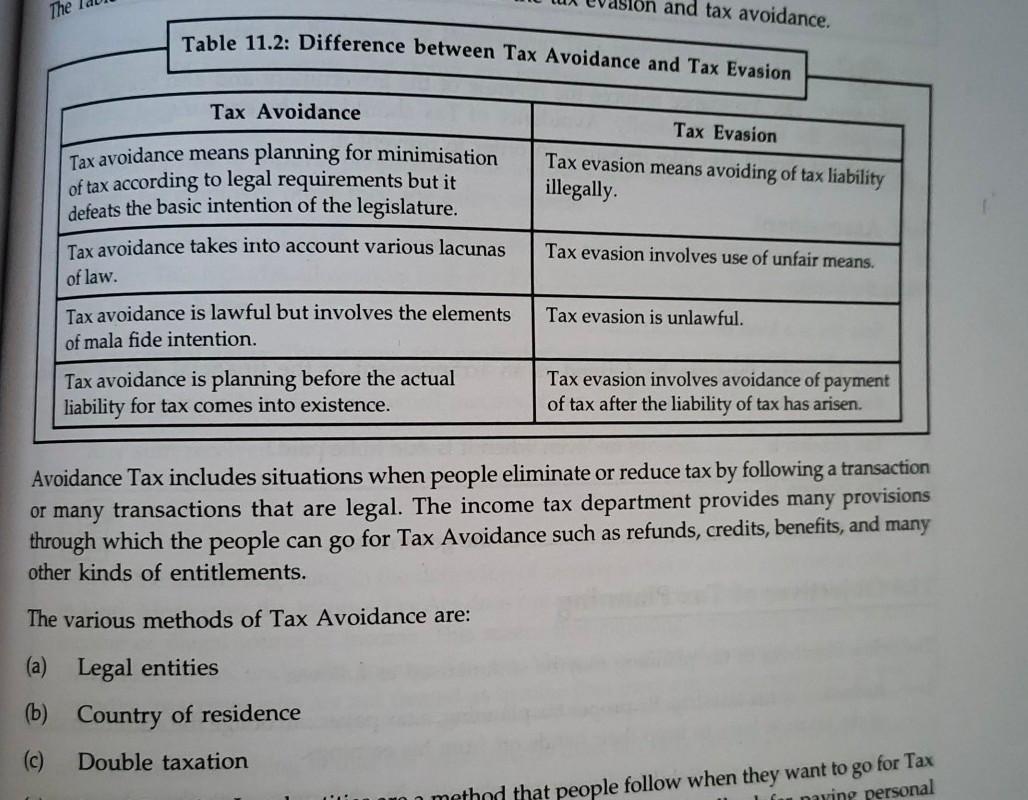

Solved The And Tax Avoidance Table 11 2 Difference Between Chegg Com

Tax Evasion Vs Tax Avoidance What Are The Legal Risks

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Difference Between Tax Evasion And Tax Avoidance Compare The Difference Between Similar Terms

Tax Evasion Vs Tax Avoidance Definitions Prison Time India Dictionary

Wkisea Treading The Fine Line Between Tax Planning And Tax Avoidance